In this feature we look at two very popular Canadian credit cards and the return you get from them for your everyday spending. One has a fixed point rewards chart system while the other is a straight cash back towards any travel purchase. The cards are the RBC Avion Visa Infinite and the mbna rewards World Elite Mastercard . The RBC card has your traditional reward chart system whereas the mbna card is your book travel anywhere and redeem against the charge system.

With RBC's reward chart system they have set out a points requirement for various regions of travel, short haul North America, long haul North America and so on. That fixed reward chart points requirement means that you have to use a set number of points to redeem for travel within that region. Taking short haul for example, you need to redeem 15,000 points for tickets that can cost up to $350 before taxes and fees. Doesn't matter if the actual ticket costs $150, $250 or $350 you need to redeem 15,000 points for it. The same goes for the other regions on the reward chart. To utilize the RBC reward chart you have to book via RBC Rewards at least 14 days in advance. As the card earns 1 RBC Rewards Point per dollar spend on the card (1.25 for travel purchases) the card provides anywhere from a 1% to 2.9% return on your spending (2.9 is if all your spending is on travel). As you'll see further on in this feature however getting above 2% is very limited.

Click on the chart to see it larger

mbna's system it works differently in that you simply redeem against any travel charge you put onto your card. If a ticket costs $150 dollars you can redeem 100 points to 15,000 points against that charge for $1 to $150 credit to your account respectively. There is no limitation on when, where or who you book with. Since the card earns 2 Miles per dollar spent it provides a straight 2% return on your spending when you redeem for travel.

So which one gives you a better return, the fixed reward chart system or the fixed cash back system? Let's take a look:

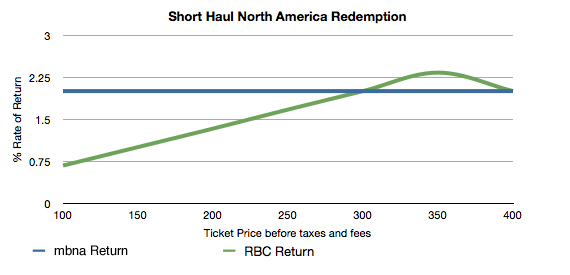

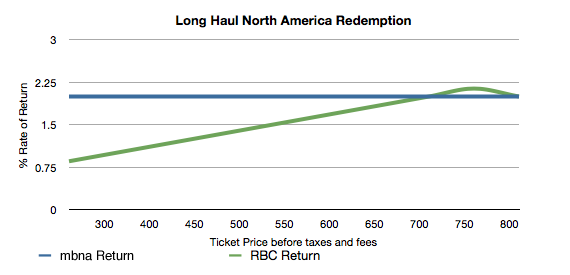

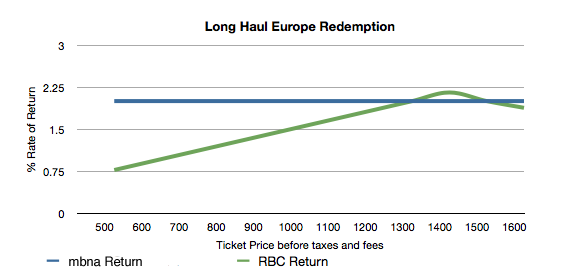

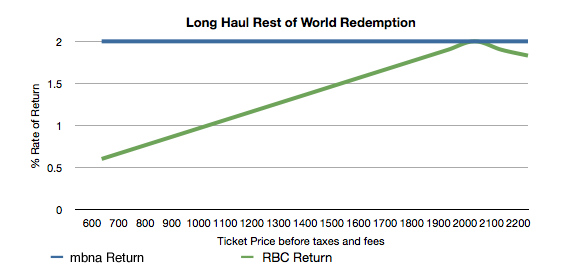

Rate of return when looking at travel redemptions before taxes and fees

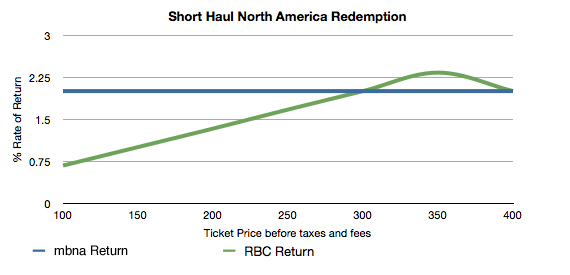

Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. This does not include taxes or fees.

Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. This does not include taxes or fees.

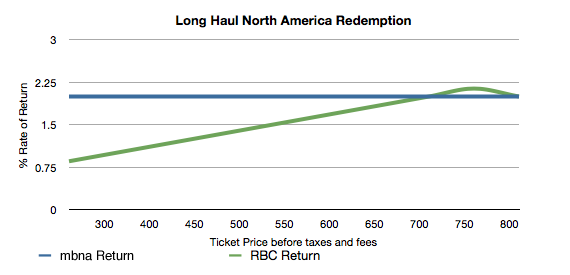

Long Haul North America is for travel within Canada or the U.S. excluding Hawaii or Alaska. The RBC Avion award chart requires 35,000 RBC Rewards points for this redemption up to a maximum ticket value of $750. If the base ticket price is over $750 you would use the 35,000 points to cover the first $750 and then redeem 100 points per dollar for every dollar over and above $750. This does not include taxes or fees.

Long Haul North America is for travel within Canada or the U.S. excluding Hawaii or Alaska. The RBC Avion award chart requires 35,000 RBC Rewards points for this redemption up to a maximum ticket value of $750. If the base ticket price is over $750 you would use the 35,000 points to cover the first $750 and then redeem 100 points per dollar for every dollar over and above $750. This does not include taxes or fees.

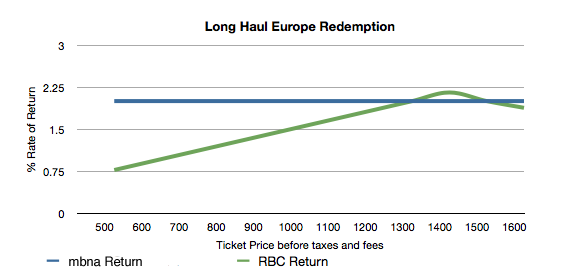

Long Haul Europe is for travel from Canada to Europe. The RBC Avion award chart requires 65,000 RBC Rewards points for this redemption up to a maximum ticket value of $1,300. If the base ticket price is over $1,300 you would use the 65,000 points to cover the first $1,300 and then redeem 100 points per dollar for every dollar over and above $1,300. This does not include taxes or fees.

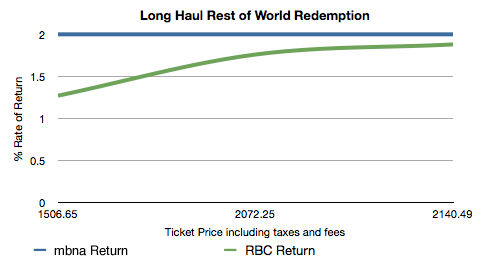

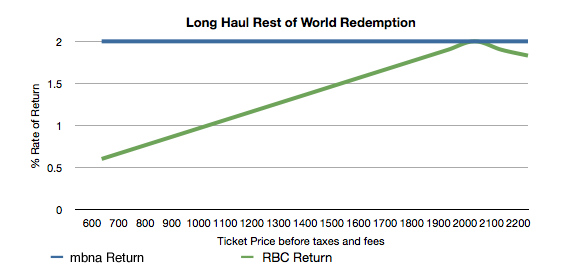

Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees.

Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees.

As you can see in each of the charts above there are actually very small ranges for the RBC® Visa Infinite‡ Avion® cards where their rate of return matches or exceeds that of the fixed rate mbna Rewards World Elite Mastercard. In most cases the straight 2% return for the mbna card is better than the RBC card. There are two more sections of RBC's reward chart we didn't provide in the above comparisons which cover sun destinations like Hawaii, Caribbean and Mexico but the results are essentially similar to above.

Rate of return when looking at travel redemptions including taxes and fees

Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

| Route |

Base Ticket Price |

Taxes & Fees |

Total Price |

Toronto-New York

(Air Canada)

|

$230 |

$134.45 |

$364.45 |

Calgary-Vancouver

(Air Canada)

|

$344 |

$84.66 |

$428.66 |

Winnipeg-Toronto

(WestJet) |

$308 |

$84.86 |

$392.86 |

Long Haul North America is for travel within Canada or the U.S. excluding Hawaii or Alaska. The RBC Avion award chart requires 35,000 RBC Rewards points for this redemption up to a maximum ticket value of $750. If the base ticket price is over $750 you would use the 35,000 points to cover the first $750 and then redeem 100 points per dollar for every dollar over and above $750. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

| Route |

Base Ticket Price |

Taxes & Fees |

Total Price |

Regina-Los Angeles

(WestJet) |

$379.99 |

$136.92 |

$516.91 |

Vancouver-Orlando

(WestJet) |

$557.99 |

$154.86 |

$712.85 |

St. John's-Edmonton

(Air Canada) |

$610 |

$173.89 |

$783.89 |

Long Haul Europe is for travel from Canada to Europe. The RBC Avion award chart requires 65,000 RBC Rewards points for this redemption up to a maximum ticket value of $1,300. If the base ticket price is over $1,300 you would use the 65,000 points to cover the first $1,300 and then redeem 100 points per dollar for every dollar over and above $1,300. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

Long Haul Europe is for travel from Canada to Europe. The RBC Avion award chart requires 65,000 RBC Rewards points for this redemption up to a maximum ticket value of $1,300. If the base ticket price is over $1,300 you would use the 65,000 points to cover the first $1,300 and then redeem 100 points per dollar for every dollar over and above $1,300. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

| Route |

Base Ticket Price |

Taxes & Fees |

Total Price |

Montreal-Paris

(Air Canada) |

$915 |

$135.38 |

$1050.38 |

Calgary-London

(WestJet) |

$1091 |

$210.53 |

$1301.53 |

Toronto-Copenhagen

(British Airways) |

$912 |

$540.92 |

$1452.92 |

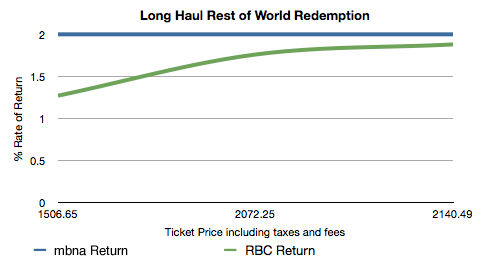

Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

| Route |

Base Ticket Price |

Taxes & Fees |

Total Price |

Vancouver-Hong Kong

(Cathay Pacific) |

$1321 |

$185.65 |

$1506.65 |

Calgary-Sydney, AU

(Air Canada) |

$1900 |

$172.25 |

$2072.25 |

Toronto-Rio

(Air Canada) |

$2016 |

$124.49 |

$2140.49 |

As you can see when you bring taxes and fees into the mix, the fact that you can use your mbna Rewards miles towards them with no dilution makes the card significantly better than RBC. When adding in RBC's redemption rate of 100 points to $1 of taxes and fees it quickly eats away at the higher returns their chart affords its cardholders. In our searches and comparison we couldn't get to a 2% return on any ticket via RBC.

You will want to note that we are only looking at two of the most popular Canada, the mbna rewards World Elite Mastercardis ranked the #2 Travel Points card in Canada while the RBC Visa Infinite Avion is ranked 5th overall in our 2018 Top Credit Card Ranking There are many other cards that fall into the same category as the mbna card which provide straight returns of 1% to 5% (although the 5% is only on select category purchases) and there are other cards like the CIBC Aventura that run the same as Avion with a fixed points reward chart. The reward chart system also reflects upon programs like Aeroplan, AIR MILES, and other frequent flyer or frequent guest programs that use a reward chart based system. Those latter ones can become more complex to compare however as they have varying earn rates, varying redemptions for economy or premium class travel etc. that can make your rate of return fluctuate. However when it comes to economy class flight redemptions they are still similar to the RBC model. So while we only look at two cards in this case study you could replace them with many others and generally come out with the same results.

With that being said you'll want to read some of our related topics on proprietary credit card programs like mbna's and RBC's:

Conclusion

To conclude our case study we would be hard pressed not to go with a Fixed Return Travel Card over a Reward Chart Travel Card. Unless you require the RBC Visa Infinite Avion hybrid option of being able to convert RBC Rewards points to British Airways, WestJet, Cathay Pacific or American Airlines then you are better off with a card like the mbna Rewards World Elite Mastercard. RBC has told us in the past they consider the Infinite Avion as a hero product and one of the best offerings in Canada. The more we write about it the more we have to disagree. Don't get us wrong, it's a great card, that's we rank it high on our rankings overall but take away to conversion option to airlines and the card drops down the rankings very quickly. It may be time for RBC to rethink what they think about the card and revamp their proprietary system as they are being blown out of the water by their competitors on that front. We have always said that reward chart systems for credit cards are archaic and the few that still run them here in Canada need to forget about the past and look at the present!

Card details

More Resources on Rewards Canada:

Notes:

For all of the rate of returns in the charts above we did not take into account the 25% bonus that RBC provides for travel purchases. Based on studies and discussions with cardholders their spend on travel tends to be a small percentage of their overall spend and would not impact the results significantly.

Talk to us!

What do you think of this case study? Tell us in the comments section below or join the conversation on Facebook and Twitter!

Rewards Canada can be found on the following social media channels:

Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. This does not include taxes or fees.

Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. This does not include taxes or fees. Long Haul North America is for travel within Canada or the U.S. excluding Hawaii or Alaska. The RBC Avion award chart requires 35,000 RBC Rewards points for this redemption up to a maximum ticket value of $750. If the base ticket price is over $750 you would use the 35,000 points to cover the first $750 and then redeem 100 points per dollar for every dollar over and above $750. This does not include taxes or fees.

Long Haul North America is for travel within Canada or the U.S. excluding Hawaii or Alaska. The RBC Avion award chart requires 35,000 RBC Rewards points for this redemption up to a maximum ticket value of $750. If the base ticket price is over $750 you would use the 35,000 points to cover the first $750 and then redeem 100 points per dollar for every dollar over and above $750. This does not include taxes or fees.

Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees.

Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees. Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

Short Haul is travel to a neighbouring province or state. The RBC Avion award chart requires 15,000 RBC Rewards points for this redemption up to a maximum ticket value of $350. If the base ticket price is over $350 you would use the 15,000 points to cover the first $350 and then redeem 100 points per dollar for every dollar over and above $350. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

Long Haul Europe is for travel from Canada to Europe. The RBC Avion award chart requires 65,000 RBC Rewards points for this redemption up to a maximum ticket value of $1,300. If the base ticket price is over $1,300 you would use the 65,000 points to cover the first $1,300 and then redeem 100 points per dollar for every dollar over and above $1,300. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

Long Haul Europe is for travel from Canada to Europe. The RBC Avion award chart requires 65,000 RBC Rewards points for this redemption up to a maximum ticket value of $1,300. If the base ticket price is over $1,300 you would use the 65,000 points to cover the first $1,300 and then redeem 100 points per dollar for every dollar over and above $1,300. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows: Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows:

Long Haul Rest of World is for travel from Canada to Asia, Africa, South America, Australia, New Zealand and South Pacific. The RBC Avion award chart requires100,000 RBC Rewards points for this redemption up to a maximum ticket value of $2,000. If the base ticket price is over $2,000 you would use the 100,000 points to cover the first $2,000 and then redeem 100 points per dollar for every dollar over and above $2,000. This does not include taxes or fees. Taxes and fees are also redeemed at 100 points per dollar and are included in the rate of return comparison. Trips compared are as follows: