The American Express® Gold Rewards Card, which is one of the longest tenured cards in Canada, shook up the market when it received a major overhaul back in 2010. The enhancements at that time made it the top travel rewards card in Canada. A title it held from 2011 to 2017. It was knocked out of that spot by the current champ, its sibling, the American Express Cobalt® Card. With numerous changes making the Cobalt Card even better in 2021 the Gold Rewards Card seemed stuck in limbo and it needed something that would differentiate it and keep it a strong contender in the Canadian market. Those changes came in September of 2021 and it is this latest version of the card that we cover in this review.

The review of the American Express Gold Rewards Card is broken down into the following sections:

Overview

The American Express Gold Rewards Card is a card targeted towards Canadians who love to travel and want to avail of benefits that can make that travel better but don't require or want to pay for an Ultra Premium Card like the The Platinum Card® from American Express. The card offers airport lounge access membership with annual free visit passes, an annual travel credit, a NEXUS credit and pretty strong travel insurance coverage - all of which should appeal nicely to travel enthusiasts. It may not earn points as quickly as the Cobalt Card but the earn rates the card does have along with redemption options make its earn-burn capabilities very respectable and better than most non-Amex cards in Canada.

Costs & Sign up Features

Fees

The American Express Gold Rewards Card has an annual fee of $250. This is higher than many premium cards it competes against but lower than the ultra premium cards - it kind falls into its own place in the annual fee category. That $250 fee is more than made up for with all the benefits the card provides. For additional cards the first one is free which is a rarity for almost all premium and ultra premium cards. Any additional cards after the first one are $50 per year.

Welcome Bonus

Right now the American Express Gold Rewards Card has a welcome bonus of up to 60,000 Membership Rewards points:

- New American Express® Gold Rewards Cardmembers, earn 5,000 Membership Rewards® points for each monthly billing period in which you spend $1,000 in net purchases on your Card

Income Requirements

Just like all American Express cards there is no minimum income requirement to apply for this card. Approvals will be based upon credit history and other factors.

Earning

The card earns Membership Rewards points like other proprietary American Express cards and has category multipliers on the types of purchases:

- 2 Points per dollar spent at eligible gas stations, grocery stores and drugstores in Canada

- 2 Points per dollar spent on eligible travel purchases worldwide

- 1 Points per dollar spent on all other eligible purchases

To see where you can earn these multipliers be sure to check out our American Express Cobalt™ Card Confirmed Multiplier Locations as many of those merchants will be the same for the Gold Rewards Card.

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Rate of return when booking your own travel | Rate of return Cash Back | Rate of return when booking Amex's Fixed Points for Travel | Rate of return when converting to airline & hotel programs |

|---|---|---|---|---|---|

| Gas / Grocery / Drug Store | 2 | 2% | 2% | up to 4% | 2% to 12% or higher |

| Travel | 2 | 2% | 2% | up to 4% | 2% to 12% or higher |

| All other spending | 1 | 1% | 1% | up to 2% | 1% to 6% or higher |

Redeeming

The American Express Gold Rewards Card participates in Amex's Membership Rewards program which is the best credit card reward program in Canada as it has so many valuable redemption options. You can redeem points for any travel you book with the card, you can redeem points for any purchase you make on the card, you can redeem via Amex's Fixed Points for Travel and you can convert your points to Air Canada Aeroplan, Air France KLM Flying Blue, British Airways Executive Club, Marriott Bonvoy and numerous other programs.

If you redeem using the Use Points for Purchases option, you will get a $10 credit towards every 1,000 points redeemed for a purchase. This means the purchases you make on this card will equate to up to a 2% return.

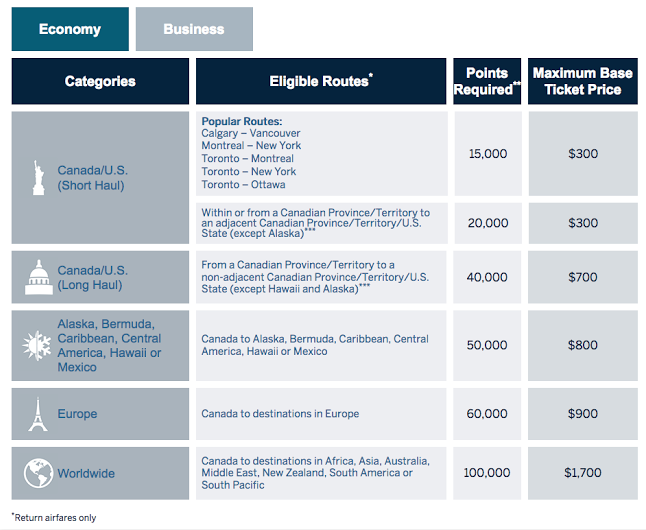

Moving on to the Fixed Points Travel Program, the card provides great value here as well. Being able to earn up to 2 points per dollar means you can be flying for as little as $7,500 in spending on this card and provides up to a 4% return on those dining and food delivery purchases. Here are the Fixed Points award charts:

From the above you'll see you only need 15,000 points for popular short haul round trip flights. Make that spending with 2x multipliers and you have that ticket for only $7,500!

Finally, another huge and I mean huge benefit to the redemption side of this card is the ability to convert to Membership Rewards Frequent Traveller participants. You can transfer the points earned on this card to six airline programs and two hotel programs. With minimum point values of 1 cent for Marriott, 1.5 cents for Aeroplan and British Airways you are looking at returns of 2 to 3% for the 2x points earning categories! But that's a minimum - there are so many occasions where you can get 3, 4 or even more cents per points with this programs that puts the Gold Rewards Card's return easily into double digits!

Current Membership Rewards Transfer partners and the transfer ratio:

- Air Canada Aeroplan - 1 to 1

- Air France KLM Flying Blue - 1 to 0.75

- British Airways Executive Club - 1 to 1

- Cathay Pacific Asia Miles - 1 to 0.75

- Delta SkyMiles - 1 to 0.75

- Etihad Airways Guest - 1 to 0.75

- Hilton Honors - 1 to 1

- Marriott Bonvoy - 1 to 1.2

Features and Benefits

Airport Lounge Access

The American Express Gold Rewards Card offers an annual Priority Pass membership which normally costs up to US$99 per year. The membership provides discounted access to over 1,200 lounges worldwide.

The card also provides four (4) complimentary visits per calendar year for access to Plaza Premium Lounges in Canada.

Annual Travel Credit

Upon approval for the card and then each year on your card's anniversary date you will receive a $100 travel credit that can be used towards any single travel booking of $100 or more charged to Card with American Express Travel Online.

The Hotel Collection

The Hotel Collection from American Express provides up to a $100 USD hotel credit at participating properties and a room upgrade, when available. This is available at over 600 participating hotels and resorts in over 30 countries worldwide, when booking a minimum of two consecutive nights with American Express Travel.

Amex ExperiencesTM

As with all American Express Cards the card comes with Amex ExperiencesTM which includes Front Of The Line® Advance Access, Front Of The Line® Reserved Tickets, Front Of The Line® E-Updates, Special Offers & Experiences for all Cardmembers and Social Access for all Cardmembers.

Amex Offers

As with all American Express Cards the American Express Gold Rewards Card receives Amex Offers. These exclusive limited time offers sent out to cardmembers to receive statement credits or bonus points for using their card at select merchants. Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to American Express Canada 'Amex Offers'

NEXUS Statement Credit

You can receive up to $50 CAD in statement credits every four years when NEXUS application or renewal fees are charged to your American Express Gold Rewards Card.

Two card colours

The American Express Gold Rewards Card is now issued as a metal card and you request to receive it in the standard gold colour or the popular new Rose Gold colour option.

Insurance

The Gold Rewards comes with a very strong insurance package that includes the following:

- Out of Province/Country Emergency Medical Insurance (up to 15 days for hose under age 65)

- Trip Cancellation Insurance

- Trip Interruption Insurance

- Flight Delay Insurance

- Baggage Delay Insurance

- Lost or Stolen Baggage Insurance

- Car Rental Theft and Damage Insurance

- Hotel Burglary Insurance

- $500,000 Travel Accident Insurance

- Purchase Protection Plan

- Buyer's Assurance Protection Plan

What is good about this card

Having decent point earn rates coupled with the best redemption options in market make it a strong rewards card. This includes the cards being one of the few left in Canada that has a category accelerator on drug store purchases.

The benefits are good! Having the lounge access with four Plaza Premium passes each year and the $100 annual travel credit make it worth paying the $250 per year for the card.

The first additional card having no annual fee! Most cards that compete with this card charge a $50 to $75 fee for the first additional card so if you do require an additional card member it brings the Gold Rewards Card's $250 annual fee closer to what you would pay with those other cards.

The sign up bonus is another strong point, up to 60,000 points is worth a minimum of $600 towards travel or cash back and the potential for well over $900 when converting to airline & hotel partner programs.

What is not so good about this card

As many of you know American Express has lower acceptance than Visa or Mastercard so there will be occasions where you cannot use this card to pay for items. Depending on where you live or travel, American Express does state that they are accepted at roughly between 80 and 90% of locations that take the other two brands of cards.

The $250 annual fee is definitely something to consider. It is higher than some comparable cards that offer lounge access with four annual passes. It really boils down to if you know you can utilize the annual $100 travel credit or require an additional cardmember. If you those latter benefits don't apply to you, you may find the $250 annual fee hard to justify.

Even though the card has a strong insurance package some consumers may find the Out of Province Emergency Medical Coverage not as strong as some other cards. The coverage of 15 days to age 64 is standard for American Express however competing there are many premium and ultra premium cards offering coverage up to 31 days or longer for those up to age 64 and even provide a few days coverage for those 65 and over.

Who should get this card

- Consumers who make a lot of purchases at drug stores coupled with grocery and gas station purchases

- Consumers who want access to lounges across Canada and around the world

- Consumers who are not ready for or don't require a card as high up as the Platinum Card from American Express

- Consumers who want the utmost in flexibility when redeeming their points by having great redemption options

Conclusion

The American Express® Gold Rewards Card is the middle ground travel rewards card from Amex Canada's portfolio of cards. It fits in nicely between the Cobalt Card and the Platinum Card. It is a card for someone who wants some extra benefits and insurance coverage when compared to the Cobalt Card but doesn't need everything the Platinum Card provides at its higher $799 per year fee. For some consumers, they are actually adding this card on top of their Cobalt Card - using the Cobalt to maximize their points earning and then enjoying the benefits afforded to them by the Gold Rewards Card. Overall it fits a niche spot in our market but even with that we still rank it as the third best card in Canada so you won't be going wrong if you choose to get it.

Latest card details:

American Express® Gold Rewards Card®

Earn up to 60,000 Membership Rewards® points:

Annual Fee: $250 | Additional Card Fee: $0 for first additional a card, $50 for all others | Annual interest rate 21.99% on purchases and 21.99% on funds advances; Missed payment applicable rates, 25.99% - 29.99% Variable

Earn up to 60,000 Membership Rewards® points:

- New American Express® Gold Rewards Cardmembers, earn 5,000 Membership Rewards® points for each monthly billing period in which you spend $1,000 in net purchases on your Card

- Earn 2 points for every $1 in Card purchases for eligible travel purchases, including flights, hotels, car rentals, cruises, and more

- Earn 2 points for every $1 in Card purchases at eligible gas stations, grocery stores and drugstores in Canada, and 1 point for every $1 in Card purchases everywhere else

- The Card is now available in your choice of Gold or Rose Gold metal options

- Receive a $50 CAD statement credit when a NEXUS application or renewal fee is charged to your American Express Gold Rewards Card

- You have access to an annual $100 CAD Travel Credit, compliments of your American Express Gold Rewards Card. Use the credit once annually towards any single travel booking of $100 or more charged to your Gold Rewards Card through American Express Travel Online

- As a Gold Rewards Cardmember, you can receive complimentary membership in Priority PassTM – one of the world’s largest independent airport lounge programs. Escape the chaos of airports and relax in an oasis of calm and simply enjoy the fact that the travel experience has begun before your plane has even left the ground. Enrollment is required and entry fees apply

- Enjoy four (4) complimentary visits per Calendar year to Plaza Premium Lounges across Canada. Entry fees apply once complimentary visits have been used

- Charge any eligible purchase to your credit Card then log in to redeem your earned points for a statement credit

- Transfer points 1:1 to several frequent flyer and other loyalty programs

- 1 Free Additional Gold Rewards Card (a $50 value) to help you earn points faster

- Subject to approval. The preferred rate for purchases is 21.99% and funds advances is 21.99%. If you have Missed Payments, the applicable rates for your account will be 25.99% and/or 29.99%. See the information box included with the application for the definition of Missed Payment and which rates apply to charges on your account and other details

- *American Express is not responsible for maintaining of monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

- Click here to apply for the American Express Gold Rewards Card

Other cards to consider if you are looking at this card:

American Express Cobalt® Card

The Platinum Card® from American Express

BMO AscendTM World Elite®* Mastercard®*

CIBC Aventura® Visa Infinite* Card

MBNA Rewards World Elite® Mastercard®

Scotiabank Passport Visa Infinite card

Subscribe to our newsletters

Be sure to subscribe to the Rewards Canada News and RWRDS Bonus Bulletin email newsletters so that you don't miss out on any loyalty program news and offers! You can subscribe to our newsletters here:

About the author

Patrick Sojka

Patrick is one of Canada's foremost leading experts on loyalty programs and credit cards. Having founded Rewards Canada in 2001 he brings nearly 24 years of experience to the forefront of helping Canadians make the most of their rewards. He has also provided consulting to credit card companies, airlines, hotels and is regularly featured in the media for his expertise on loyalty programs and credit cards.

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!