American Express® Business Gold Rewards Card

First posted on May 19, 2022

Overview

The American Express® Business Gold Rewards Card has been a mainstay in American Express' Small Business card portfolio for quite sometime now. The card underwent some slight changes in 2021 that saw its bonus earn rate structure change, had its annual fee decrease and had mobile device insurance added. So let's take a look at what this card has to offer.

Costs & Sign up Features

Fees

The American Express Business Gold Rewards Card has a $199 annual fee for the primary card and additional cards run $50 per year.

Welcome bonus

Right now the American Express Business Gold Rewards Card has a welcome bonus offering up 40,000 Membership Rewards points:

- Earn a welcome bonus of 40,000 Membership Rewards® points after spending $7,500 in purchases within the first three months of Cardmembership

- Plus, earn 10,000 bonus points in each calendar quarter when you spend $20,000 or more. That could add up to $400 in value every year

- That’s $400 in statement credits that can be reinvested in your business

Rates & Income Requirements

One of the key features of American Express' Small Business Cards is their extended period to make payments without being charged interest. In this case for the Business Gold Rewards Card you have up to 31 days which means for many purchases that gives upwards of 55 interest free days from purchase to payment. The interest rate on the card is 21.99% on Flexible Payment Option limit and 30% on Due In Full balance.

Just like all American Express cards there is no minimum income requirement to apply for this card. Approvals will be based upon credit history and other factors.

Earning

Like other proprietary American Express cards the card earns Membership Rewards points. Those points are earned as follows:

- 1 Points per dollar spent on all other eligible purchases

- 10,000 bonus points when you spend $20,000 per calendar quarter on the card

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Rate of return when booking your own travel | Rate of return Cash Back | Rate of return when booking Amex's Fixed Points for Travel | Rate of return when converting to airline & hotel programs |

|---|---|---|---|---|---|

| All spending | 1 | 1% | 1% | up to 2% | 1% to 6% or higher |

Redeeming

The American Express Cobalt Card participates in Amex's Membership Rewards program which is the best credit card reward program in Canada as it has so many valuable redemption options. You can redeem points for any travel you book with the card, you can redeem points for any purchase you make on the card, you can redeem via Amex's Fixed Points for Travel and you can convert your points to Air Canada Aeroplan, Air France KLM Flying Blue, British Airways Executive Club, Marriott Bonvoy and numerous other programs.

If you redeem using the Use Points for Purchases option, you will get a $10 credit towards every 1,000 points redeemed for a purchase. This means the purchases you make on the card will equate to a 1% return (not including any of the 10,000 points for $20,000 spending bonus)

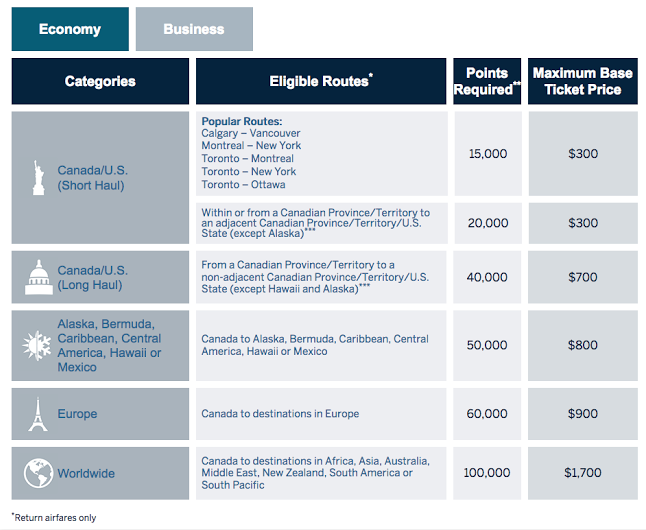

Moving on to the Fixed Points Travel Program, the card provides great value here as well. Being able to earn up to 5 points per dollar means you can be flying for as little as $15,000 in spending on this card and provides up to a 2% return on your purchases. Here are the Fixed Points award charts:

Finally, another huge and I mean huge benefit to the redemption side of this card is the ability to convert to Membership Rewards Frequent Traveller participants. You can convert the Membership Rewards points earned on this card to six airline and two hotel programs. The most popular are Air Canada and British Airways - both of which are 1:1 transfers and to Marriott Bonvoy which are 1:1.2. We value Aeroplan Points and British Airways Avios at 1.5 cents each at a minimum which means your base spending on this card works out 1.5%. But that's a minimum - there are so many occasions where you can get 3, 4 or even more cents per points if you redeem for business class or higher flights with these programs so that puts your return even higher.

Those are all the travel redemption options but then the Membership Rewards has its cash back option. Amex calls it Use Points for Purchases and this option works exactly like the any travel any time redemption. You can simply redeem 1,000 points for a $10 statement credit to any eligible purchase made on the card. By eligible it means an actual purchase, you can't redeem points towards interest charges, cash advances etc. With that 1,000 points to $10 redemption rate the American Express Business Gold Rewards cards provides a 1% cash back return not including that quarterly bonus rates.

After this you have other redemption options like merchandise, prepaid American Express cards and some others that are more of a last resort type redemption as these provide the least amount of value for your points.

Features and Benefits

The American Express® Business Gold Rewards Card provides access to The Hotel Collection from American Express which provides benefits at over 600 participating hotels and resorts in over 30 countries worldwide. Simply book a minimum of two consecutive nights at participating properties with American Express Travel using this card and receive:

- Up to a $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room.

- A one-category room upgrade at check-in, when available.

As with all American Express Cards the card comes with American Express Invites which includes Front Of The Line® Advance Access, Front Of The Line® Reserved Tickets, Front Of The Line® E-Updates, Special Offers & Experiences for all Cardmembers and Social Access for all Cardmembers.

The card comes with a pretty strong insurance package as well! Here is what is included:

- Employee Card Misuse protection

- Car Rental CDW - up to 48 days & $85,000 MSRP Coverage

- Lost or stolen baggage

- Hotel burglary

- Flight delay

- Baggage delay

- $100,000 travel accident / common carrier

- Purchase Protection

- Extended warranty

- Mobile device insurance

As seen on the consumer cards, this Small Business card also provides the Amex Offers benefit. Amex Offers continually provides special deals at select retailers when you use your registered American Express card. The deals are typically a statement credit after you meet a minimum spend with a retailer but we have also seen discounts and bonus points offers as well. The Amex Offers program can in many cases pay for the annual fee on this card several times over each year. We have a complete Guide to American Express Canada 'Amex Offers' where you can learn more about the Amex Offers program.

What is good about this card

The first thing that is good about this card is the current welcome bonus of 40,000 points. This bonus is worth $400 towards any travel or cash back and actually goes well beyond $600 in value with the Fixed Points for Travel option or the conversion to Air Canada or British Airways.

Next up in what is good about this card is the Membership rewards program - it the best proprietary credit card program in Canada. You multiple redemptions options where the points you have earned will not lose value, for the most part the lowest return you would get on this card is 1% but as we showed above it can go above that.

Rounding out what is good about the card are the lengthy interest free days before you have to make a payment, the Amex Offers program and the insurance coverage provided is quite decent as well.

What is not so good about this card

The 1 point per dollar earn rate isn't the best nor is it the worst in the market of small business credit cards. However, seeing what other Amex cards offer we do feel the card could do better on the points earning side. This is somewhat alleviated if you can earn that 10,000 points per quarter but that banks on you being able to spend $20,000 on your account every three months. Putting that kind of hurdle to earn the bonus is not so great. What if you end up spending $19,995 in that time period? To only come $5 short and not get any bonus is a tough pill to swallow. I would have preferred if they had added category spend bonuses on the card instead.

As many of you know American Express has lower acceptance than Visa or Mastercard so there will be occasions where you cannot use this card to pay for items. Depending on where you live or travel, American Express does state that they are accepted at roughly between 80 and 90% of locations that take the other two brands of cards.

Who should get this card

- Small business owners looking to extend cash flow with up to 55 days interest free days.

- Small business owners who know they can spend $20,000 every three months

- Freelancers / side hustlers who want a good card with a really good initial welcome bonus offer

- Small business owners who want to earn very flexible reward points on their spending that they can use towards travel, cash back and more.

Conclusion

I know some people were not happy when this card went through some changes in 2021 but most of those people were those who were gaming this card's double points earn rate at the time. You could select to earn double points at three merchants of your choice which included bill payment company Plastiq. This meant a lot of non-business owners simply got this card for that reason, to pay bills via Plastiq, earn 2 points per dollar and then convert them to Aeroplan or British Airways to pull more value out of those points than the service charge for paying those bills. Well, it didn't take long for American Express to figure that out and thus we now have the 10,000 point bonus for $20,000 quarterly spend. This has made the card more of what it is intended for and that is putting a lot of various business purchases on the card. And that's exactly who should be getting this card, are the true small business owners.

Latest card details:

American Express® Business Gold Rewards Card

Earn up to 40,000 Membership Rewards® points

Annual Fee: $199 | Additional Card Fee: $50 | Purchase Interest: 21.99% on Flexible Payment Option limit and 30% on Due In Full balance

Earn up to 40,000 Membership Rewards® points with Amex’s best offer this year on this Card

- Earn a welcome bonus of 40,000 Membership Rewards® points after spending $7,500 in purchases within the first three months of Cardmembership

- Plus, earn 10,000 bonus points in each calendar quarter when you spend $20,000 or more. That could add up to $400 in value every year

- That’s $400 in statement credits that can be reinvested in your business

Earn points that you can redeem in a variety of ways

- Earn 1 Membership Rewards point for every dollar in purchases charged to the Card and get the most out of your business expenses.

- Enjoy an exceptional line-up of rewards redemption options for you and your business, including travel, dining, entertainment, gift cards, merchandise, and more with Membership Rewards program.

- Transfer points to frequent flyer and hotel programs, including one-to-one to Aeroplan®* and Avios.

Unlock business possibilities with a full suite of business management tools that give you more control over your business - anytime and anywhere

- Take advantage of purchasing power that grows with your business with no pre-set spending limit on purchases. With this Card, your purchasing power adjusts dynamically with your Card usage, and can grow over time, as long as you make your payments on time and maintain a good credit history

- Maximize your cash flow with up to 55 interest free days so you can keep more cash on hand when you need it most.

- Pay for business expenses over time with Flexible Payment Option

- This charge Card has both Due in Full and Flexible Payment Option balances. All Due in Full balances must be paid each month. Interest rate of 30% applies to each delinquent Due in Full charge. This rate is effective from the day account is opened. The Preferred rate of 21.99% applies to your Flexible Payment Option balance. If you have 2 separate Missed Payments in a 12 month period, the Flexible Payment Option rate for your account will be 25.99%. If you have 3 or more separate Missed Payments in a 12 month period, the Flexible Payment Option Rate will be 29.99%. These rates are effective from the day the Flexible Payment Option is first available on your account.

Access comprehensive insurance coverage for your travel needs.

- Access Travel Emergency Assistance, and up to $100,000 Travel Accident Insurance when you fully charge your tickets to your Business Gold Rewards Card.

- Plus, access Lost or Stolen Baggage Insurance, Flight Delay Insurance, and Baggage Delay Insurance when you fully charge your airline tickets to your Business Gold Rewards Card.

- Save money when travelling with complimentary Car Rental Theft and Damage Insurance

Access coverage that can protect your business purchases when you charge the full price of eligible items to your Business Gold Rewards Card.

- Protect your eligible purchases against accidental physical damage and theft for up to 90 days with Purchase Protection® Plan

- Double the manufacturer’s original warranty up to one additional year with Buyer’s Assurance® Protection Plan

Access to coverage for mobile devices purchased for business use.

- Access Mobile Device Insurance of up to $1,000 in the event of theft, loss or accidental damage, anywhere in the world, when you fully charge or finance the purchase price of an eligible mobile device on your Business Gold Rewards Card.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!